Back to blogs

Investment Mortgage

Why are Millennials choosing to rent over owning a home in 2023?

By Milo

May 5, 2023 • 6 min read

The American dream of homeownership has been central to the country's identity and culture for decades. However, recent data from the Census Bureau shows that more Americans than ever are choosing to rent instead. While millennials have been slower to enter the housing market than previous generations due to economic and cultural factors, over 50% now own homes, according to a report done by RentCafe. However as housing prices continue to rise, a stark divide between millennials who are homeowners and those who remain renters is growing. The same report also shows that renting is becoming increasingly popular among high earners, with the number of renters earning over $150,000 growing by 82% between 2015 and 2020. In this article, we will explore the factors behind these trends and the varying millennial perspectives on homeownership.

Key Takeaways

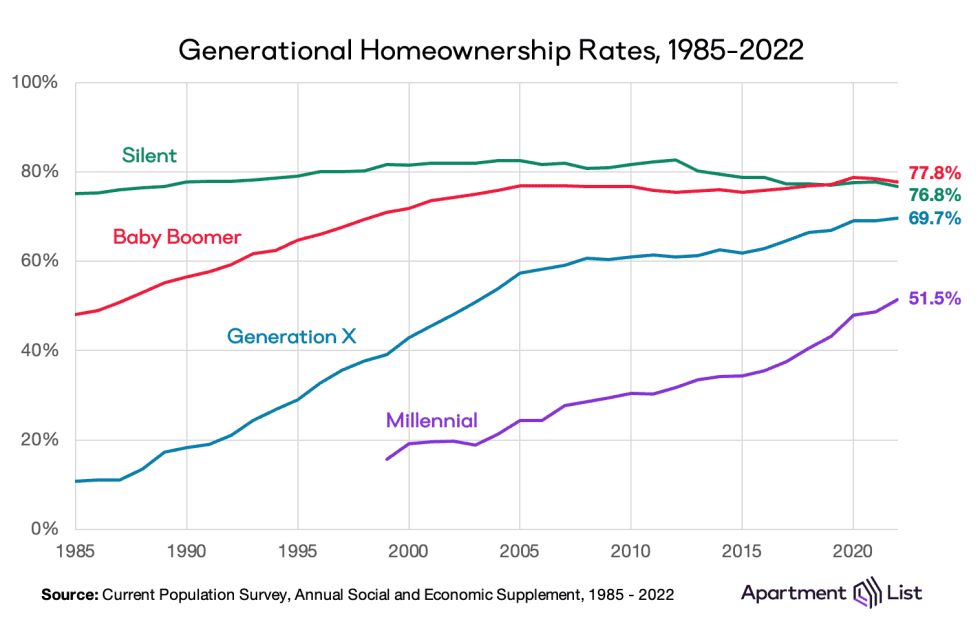

- While the current millennial homeownership rate is at 51.5%, it is still lower than the homeownership rates of previous generations, with baby boomers maintaining the highest homeownership rate at 78%.

- Many millennial renters are now saying they will rent forever, with the number of "forever renters" nearly doubling from 13 percent in 2010 to 24 percent in 2022.

- High earners, including millionaires, prefer to rent instead of buying. The number of renters with annual incomes of over $150,000 grew by 82% between 2015 and 2020, faster than renters overall, who inched up by 3.2% during the same time frame.

The current state of home ownership for millennials

The current state of homeownership among millennials has become a major topic of interest in the real estate industry. While millennials are finally achieving the goal of homeownership, with the latest millennial homeownership rate standing at 51.5%, they are doing so at a lower and slower rate than previous generations. For example, baby boomers maintain the highest homeownership rate at 78%, accounting for 39% of all homeowners while millennials have the slowest transition from renters to homeowners.

‘Forever Renters’: financial challenges facing millennials when it comes to homeownership

A number of economic and cultural factors have contributed to this trend, including the Great Recession, which suppressed homeownership across all generations but was particularly damaging to millennials. In addition, many millennials were drawn to centrally-located jobs in cities where starter homes became increasingly scarce and expensive. This led to many millennials delaying major life events like homeownership, marriage, and childbearing when compared to earlier generations.

Another major factor impacting millennials' ability to buy homes is the financial challenges they face. High student loan debt and stagnant wages have made it difficult for many millennials to save for a down payment while rising home prices and mortgage rates have made it harder for them to afford homes.

As a result, many millennials are choosing to rent instead of buying. COVID-19 further exacerbated this trend; housing inventory dropped to all-time lows when millennials purchased an outsized share of homes during the first two years of the pandemic when mortgage rates fell below 3 percent, During this same period, listing prices skyrocketed more than 40%. Homeownership opportunities waned dramatically in the years that followed for millennial renters who could not afford to buy a home in the earliest stages of the pandemic.

This has resulted in a generation that is increasingly bifurcated between homeowners and renters, with more than half of millennials having achieved homeownership while the remaining renters find it increasingly out of reach. Many millennial renters are now saying they will rent forever, with the number of "forever renters" doubling from 13 percent in 2010 to 24 percent in 2022.

The rise of the high-income renter

In contrast to millennials who feel financial strains are holding them back from achieving the ‘American Dream’, according to a newly published report by RentCafe.com, homeownership is not a priority for everyone, especially not for a substantial subset of millennials and Gen Zs, and renting is popular even among high earners who are able to buy but prefer to rent their homes instead. The report shows that the number of renters with annual incomes of over $150,000 grew by 82% between 2015 and 2020, faster than renters overall, who inched up by 3.2% during the same time frame. There are now 2.6 million high earners living in rentals in the U.S., and among them is a new kind of tenant: the millionaire renter.

High-income renters earning $150,000 or more saw rapid growth of 82% in five years — the most significant increase among all income groups — followed by renter households with annual incomes between $100,000 and $150,000. At the same time, middle-income renters grew at a slower pace but still posted double-digit increases. The only segment to register a drop was that of households earning less than $50,000, which decreased by 11.2%.

The rise of high-income renters can be partly attributed to high home prices, which made homeownership less attractive, especially for those in pricey locations. In nine of the 10 cities where the number of top-earning renters increased considerably, growth in home prices was higher than the national average (29%). Additionally, some high earners, including some millionaires, prefer to funnel their cash into other types of assets that hold value.

For these high earners, renting offers the flexibility to invest in other assets, such as stocks, bonds, and alternative investments like private equity or cryptocurrency. Renting can also provide more freedom to move around, travel, and pursue other opportunities without being tied to a specific property. However, while renting can provide many benefits, it has its downsides. Renters do not build equity in their homes, and their monthly payments are not building towards ownership. Renting also comes with the risk of rent increases, lease terminations, and the uncertainty of living in a property that may not be owned by the renter.

Despite these challenges, the trend of high earners choosing to rent is expected to continue. The RentCafe report predicts that the number of high-income renters will continue to grow, driven by factors such as rising home prices, changing attitudes towards homeownership, and the growing popularity of lifestyle renting.

Overall, the varying perspectives on homeownership among millennials and high earners highlight the changing dynamics of the real estate market. While many still aspire to own a home, others are choosing to prioritize flexibility and other investments over homeownership. As the real estate industry continues to evolve, it will be interesting to see how these trends shape the future of housing and homeownership.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.

Related articles

Primary Mortgage

Why is homeownership just out of reach for most millennials?

By Josip Rupena

June 23, 2023 • 8 min read

Learn

How 9/11 reshaped the American housing market

By Colin McMahon

September 11, 2025 • 6 min read

Investment Mortgage

Maximizing the returns of your rental property

By Milo

June 5, 2023 • 4 min read