Financing designed for modern investors

Maintain complete custody of your crypto while expanding your real estate holdings on your terms. Use your Bitcoin or Ethereum to qualify for a 2nd home or investment property.

A smarter way to invest

Your property qualifies you, not your income

Ideal for investors, entrepreneurs, & self employed who don’t fit into the traditional mortgage box.

Use your crypto, keep your custody

Hold Bitcoin or Ethereum in your own wallet and still use it to qualify as liquid reserves.

Interest-only payment option

Lower your monthly expenses and maximize cash flow.

Available to U.S. & global investors

Purchase investment properties in the U.S. No residency or citizenship required.

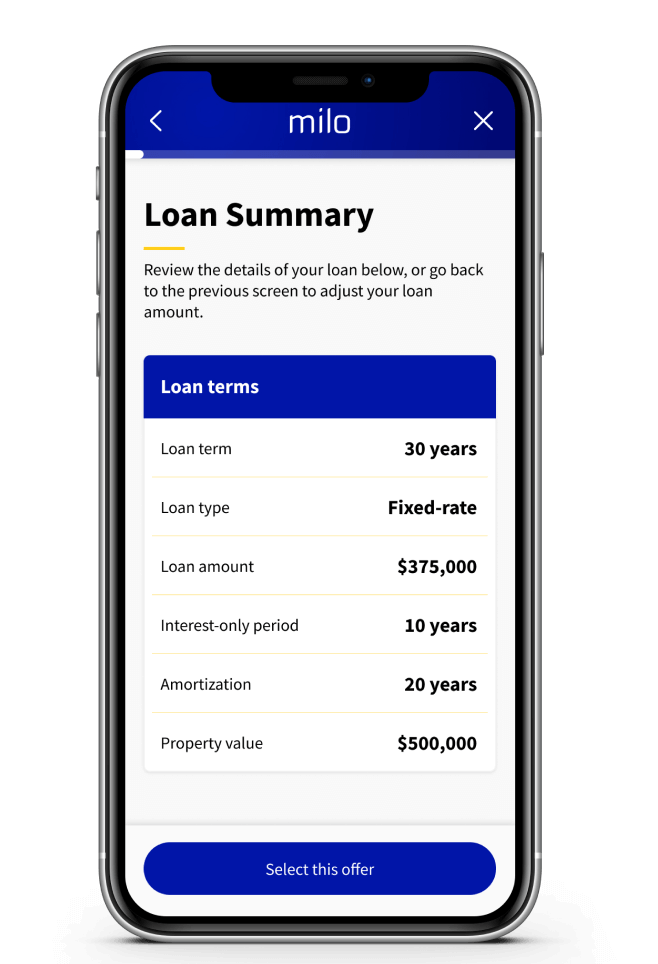

Self-custody mortgage terms

Recognized reserves

Fiat, Bitcoin & Ethereum

Interest rate

7-8%

Custody

Self-custody

Loan term

30-year fixed, interest only

Loan amount

Starting at $200,000

LTV

Up to 75%

Choose how to qualify with Milo

Whether you're leveraging rental income or crypto holdings, Milo offers two powerful ways to finance your investment property.

Want to use your crypto as collateral? Start with a crypto mortgage.

Self-custody mortgage

Crypto-backed mortgage

Best for

Maintaining full control of your crypto

Increasing your purchasing power

Crypto required

Not required, optional

Yes, pledge 1x property value

Crypto usage

Included with assets to qualify

Used as collateral

Crypto custody

Self-custody

Held with 3rd party custodian - Coinbase & BitGo

Loan-to-value (LTV)

Up to 75%

Up to 100%, no down payment

Calculate your mortgage terms

Run the numbers on your next property. Estimate payments, loan size, and more with our mortgage calculator.

Looking to refinance or cash out? Explore rates & terms.