How we compare to

traditional banks

There are lots of ways to qualify for a mortgage. Milo has numerous options because no two customers are the same.

Qualifying income

Milo

Banks

W-2

Bank statements

Asset utilization

Self-employed

DSCR

How to get pre-qualified

Start by answering a few questions about yourself and the home you’d like to buy.

1. Provide a financial overview

Self-report basic information about your income, credit score, and assets.

2. Receive a pre-qualification letter

Find out how much you may be able to afford.

3. Submit offers

Use your pre-qualification letter to show brokers and sellers you're a serious, qualified borrower.

Benefits of working

with us

Simple application

5 minutes or less

Variety of loan programs

Investment & Bridge

A global team

We understand your needs

Online closing

Remote closings available

Direct lender

We lend our own capital

Transparent fees

Fees are provided early on

Mortgage programs

Investment

Mortgage

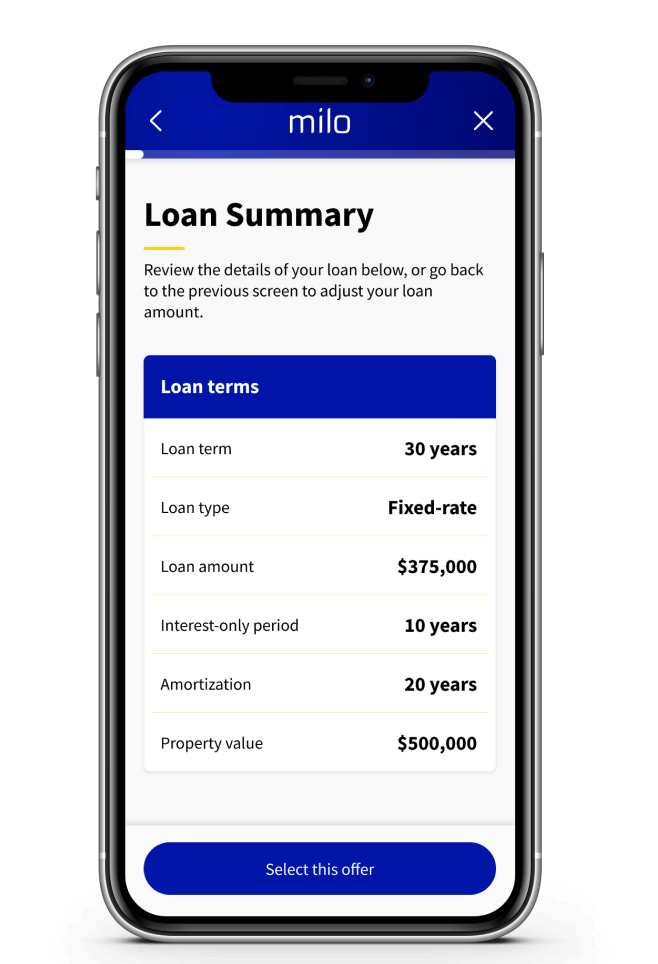

Our investment mortgage allows us to qualify you based on the property’s potential rental income, not yours.

Improve cash flow with an interest-only period

Qualify using the property’s rental income

Close in under 30 days

Bridge

Mortgage

Our bridge mortgage is for when you need to qualify and close quickly. We’ll finance up to 60% of the property’s value for a 1 to 2 year term.

Interest-only for the full term

No prepayment fee

Close in as little as 10 days

Where we lend

Milo is licensed to help real estate investors and home buyers achieve their financial goals in many U.S. states. If you don’t see your state listed below, check back soon or contact us.

Investment properties

United States

Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Washington, Wisconsin, and Wyoming.